Strengthening accountability in insurance – Senior Managers & Certification Regime

Background

The Senior Insurance Managers Regime (“SIMR”) of the Prudential Regulation Authority (“PRA”) provides a regulatory framework for standards of fitness and propriety, conduct and accountability to be applied to individuals in positions of responsibility at insurers. It sets out a list of senior insurance management functions (“SIMFs”) where individuals within those functions require the PRA’s pre-approval to perform, and various other associated regulations.

The Financial Conduct Authority (“FCA”) has a similar Approved Persons Regime (“APR”). Some executive and other functions that do not require PRA pre-approval under SIMR are considered as controlled functions under the APR.

The FCA’s Senior Managers and Certification Regime (“SM&CR”) is in place for banks, but does not currently cover insurers. The SM&CR aims to reinforce and clarify the expectations of individuals within their governance structure. The PRA and FCA are now obliged to extend the SM&CR to insurers and replace their current respective regimes and this will be implemented on 10 December 2018.

The FCA proposals for implementing and moving to SM&CR were set out in 2017 in consultation papers CP17/26 and CP17/41, whilst those from the PRA were in CP14/17 and CP28/17. In July, the FCA published PS18/15 containing feedback on the consultations, some additional clarification and near-final rules on the SM&CR. The proposals will go ahead as set out in the consultation papers. This was closely followed by CP18/18 in July and CP20/18 in September, which set out the proposed changes to the PRA rules.

The FCA has also published SM&CR: Guide for Insurers, which is a very helpful guide to the new regime and the transition process. Firms should review the Guide to ensure they understand the requirements as significant changes will be required for many firms.

In addition, the PRA’s consultation paper CP8/17 in June 2017 set out proposals to amend SIMR and to strengthen governance through requiring insurers to take steps to encourage diversity. PS1/18 was published in February 2018 with almost no changes from the consultation and then updated in July 2018 to give the same implementation date of 10 December 2018 for amendments to the SIMR. The requirement for insurers to have a diversity policy for their boards came into force in April 2018. The PRA’s SS35/15 has also been updated to reflect the changes.

Who does this apply to?

The changes affect all insurers including Solvency II firms, Insurance Special Purpose Vehicles (“IPSVs”), branches of non-UK firms and non-directive firms (“NDFs”). They affect most staff within a firm and all approved individuals (except those within firms’ Appointed Representatives).

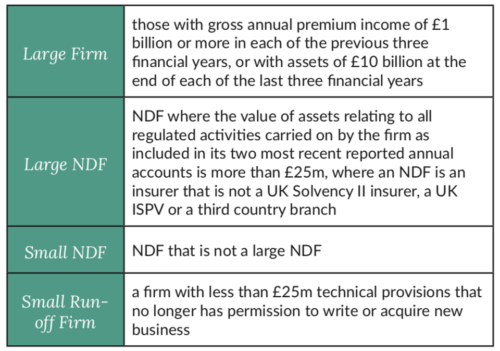

Within the firm classifications, there are the following additional splits:

Senior Managers Regime

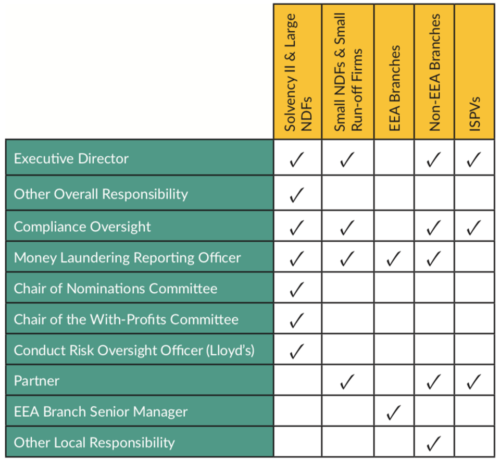

The FCA will be required to approve the most senior people performing key roles (if the roles already exist) within an insurance firm. These controlled functions are defined as Senior Management Functions (“SMFs”) and are held by persons defined as Senior Managers (“SMs”). SMFs are those functions with the greatest potential to cause harm. The FCA SMFs are shown below:

However, there is no requirement for any of the FCA SMF roles to exist; the regime just requires that, if a person does hold any of the roles above, they are approved by the FCA under SM&CR.

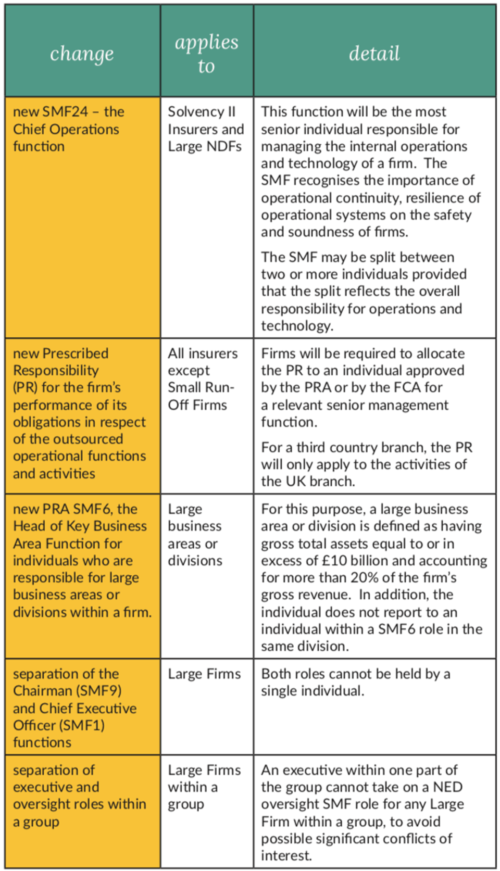

The PRA will be maintaining its current SIMFs (but they will now also be called Senior Management Functions), but there will be the following amendments:

If a firm is seeking approval from the PRA for a candidate to perform a PRA-designated SMF and also intend this candidate will perform an FCA SMF, the Overlap Rule will be applied, which means only one application needs to be made, to the PRA, provided that it also states the individual will be performing an FCA SMF. The FCA role will not be listed on the register, but the Statement of Responsibilities (see below) for the PRA SMF must include those responsibilities relating to the FCA SMF.

Certification Regime (“CR”)

Firms will need to identify certification functions, which are defined as functions where it is possible to cause significant harm to a firm or to any of its policyholders but which are not also FCA or PRA SMFs or non-executive director (“NED”) roles.

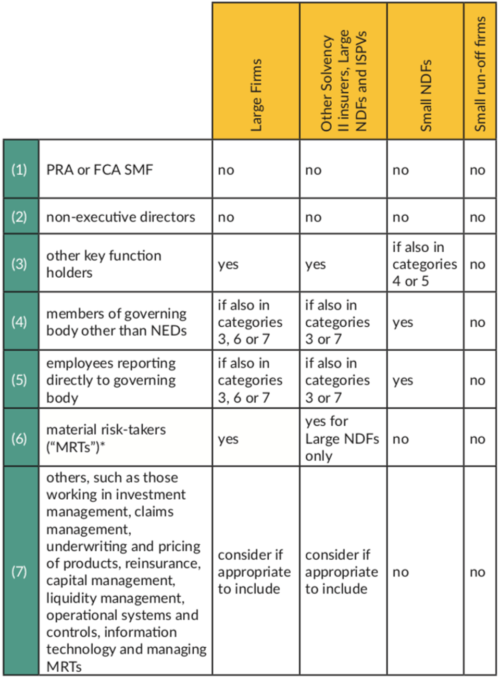

The individuals covered by the PRA changes depend on the type of firm as specified in the following table:

* MRTs are defined as employees of insurers whose professional activities have a material impact on the firm’s risk profile.

The functions covered by the FCA Certification Regime are:

- Significant Management Function

- proprietary traders

- CASS oversight function

- functions subject to qualification requirements

- Client Dealing function

- algorithmic traders

- material risk takers

- anyone who supervises or manages a person performing a Certification Function

Fit and Proper requirements

A person carrying out a certification function does not require regulator approval, but firms must provide certificates to individuals in certification functions at least annually and keep a record of these certificates. This is to show that the firm is satisfied the individual is fit and proper. A firm must propose steps in relation to an individual if the decision is not to issue a certificate.

Regulatory references

Firms will be required to obtain regulatory references before appointing individuals to SMFs and certification functions.

All regulatory references rules as they currently apply to other insurers will be extended to small NDFs as well. In particular, these firms will need to request references going back six years for all individuals being appointed to a SMF or a certification function (new employees or existing employees moving roles) at the NDF and include mandatory information in the references provided to other firms.

Click here to download this article as a PDF.

Senior Actuary

Tel: 01372 847587

Email: alison.carr@sda-llp.co.uk

Read Alison’s biography